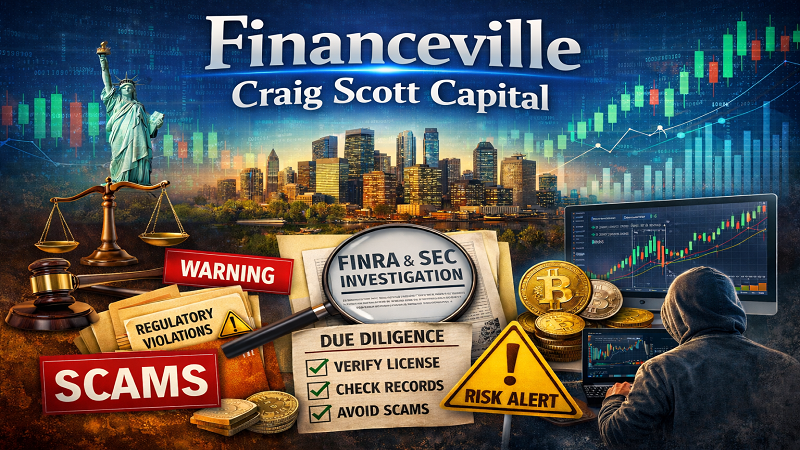

The financial world is full of names, brands, and platforms that appear authoritative but require careful examination before being trusted. One such topic that has gained online attention is financeville craig scott capital. This term often appears in financial articles, educational blogs, and search results, leaving many readers uncertain about its meaning, legitimacy, and relevance in today’s financial environment.

This article is designed to provide a clear, factual, and well-structured guide that explains the origins, background, regulatory history, and modern interpretations associated with this topic. Rather than promoting any service, the goal is to help readers understand the context, identify risks, and make informed decisions when encountering similar financial names or platforms online.

Overview Table

| Category | Details |

|---|---|

| Topic Focus | Finance education, historical brokerage background, investor awareness |

| Financeville | An informational and educational finance content brand |

| Craig Scott Capital | Former U.S. broker-dealer with regulatory action history |

| Regulatory Status | No active, licensed brokerage currently operating under this name |

| Key Risks | Misleading branding, lack of oversight, investor confusion |

| Best Practice | Verify licenses, research history, avoid unregulated platforms |

Understanding Financeville as a Financial Content Brand

Financeville is commonly described as a financial education and information platform rather than a registered financial institution. Its content generally focuses on explaining financial concepts such as investing basics, market trends, risk management, and economic principles in simplified language.

Unlike licensed brokers or investment advisors, content-based platforms do not manage funds, execute trades, or provide regulated financial advice. Their role is primarily informational, aiming to improve financial literacy rather than offer personalized investment solutions.

Readers should understand that educational content, while helpful, does not replace professional advice from certified and regulated financial experts.

The Historical Background of Craig Scott Capital

Craig Scott Capital was a U.S.-based broker-dealer that operated during the early to mid-2010s. As a broker-dealer, it was subject to strict oversight by regulatory authorities responsible for protecting investors and ensuring ethical conduct in financial markets.

The firm provided securities trading services and employed registered representatives who managed client accounts. Like all regulated broker-dealers, it was required to follow rules related to transparency, suitability, supervision, and fair dealing.

However, its history is widely discussed because of serious compliance failures that eventually led to regulatory enforcement actions.

Regulatory Issues and Enforcement Actions

Financial regulators exist to protect investors from misconduct, excessive risk, and unethical behavior. In the case of Craig Scott Capital, multiple issues were identified during regulatory reviews.

Excessive Trading Practices

One of the most significant concerns involved excessive trading, sometimes referred to as churning. This practice occurs when trades are made frequently not to benefit the client, but to generate commissions. Excessive trading can significantly erode investment value due to high transaction costs.

Inadequate Supervision

Broker-dealers are legally required to supervise their representatives. Regulators found that oversight systems were insufficient, allowing problematic trading behavior to continue without proper controls.

Regulatory Outcome

As a result of these violations, the firm faced disciplinary action that ultimately led to its expulsion from regulatory membership. Once expelled, a broker-dealer can no longer legally operate as a registered securities firm in the United States.

This regulatory history is publicly documented and serves as an important lesson in the importance of compliance and ethical standards.

How the Term Is Used in Modern Online Content

Today, the phrase financeville craig scott capital often appears in online articles, blogs, or informational pages that blend financial education with historical references. This usage can sometimes cause confusion, particularly for readers unfamiliar with the regulatory background.

In many cases, the term is used:

- As a topic of discussion, not an active company

- In educational or analytical articles

-

As part of SEO-driven content explaining financial risks and history

Importantly, there is no verified evidence that a currently licensed investment firm is operating under this combined name. Any platform claiming to offer brokerage or investment services must be independently verified through official regulatory databases.

Why Regulatory Verification Matters

One of the most important lessons for investors is the need to verify legitimacy before engaging with any financial platform. Regulatory registration ensures that a firm:

- Follows legal standards

- Is subject to audits and oversight

- Offers dispute resolution mechanisms

- Can be held accountable for misconduct

Without regulation, investors have limited protection and may face difficulties recovering funds if problems arise.

Before trusting any platform, individuals should check official registries such as securities commissions or financial authorities in their country.

Investor Risks Associated With Unverified Financial Names

When historical firm names are reused or referenced without proper context, several risks may arise:

Brand Confusion

Names associated with regulated firms can give a false sense of credibility even when no active license exists.

Lack of Accountability

Unregulated platforms are not bound by investor protection rules.

Misleading Claims

Some sites may exaggerate performance potential or minimize risks to attract attention.

Understanding these risks is essential for protecting personal finances.

Key Lessons for Investors

The story behind this topic highlights several important lessons:

- Always research financial entities thoroughly

- Do not rely on names alone as proof of legitimacy

- Check regulatory status before investing

- Be cautious of platforms offering guaranteed or unusually high returns

These principles apply universally, regardless of market conditions or investment trends.

The Role of Financial Education

Financial education platforms can play a positive role when they focus on transparency and learning rather than promotion. When used responsibly, educational resources help individuals:

- Understand market fundamentals

- Recognize common investment risks

- Make informed decisions

- Avoid scams and misinformation

However, education should always be paired with critical thinking and verification.

Modern Relevance of financeville craig scott capital

In today’s digital environment, financeville craig scott capital serves more as a case study and informational topic rather than an operational financial entity. Its continued appearance online reflects the broader challenge of navigating financial information in an era where content is easily published but not always regulated.

Readers should approach such topics with curiosity, caution, and a commitment to due diligence.

Conclusion

The financial landscape rewards informed and cautious participants. Understanding the background, regulatory history, and modern usage of terms like financeville craig scott capital helps readers separate educational content from active financial services.

By focusing on verification, regulatory awareness, and sound financial principles, investors can protect themselves from unnecessary risk and make decisions based on facts rather than appearances.